Don't Be a Victim: Your Cheat Sheet to Scam-Proof Your Life

Author: Adam Collins

In today's digital age, online scams, and fraudulent activities have become more sophisticated than ever before. Scammers are getting creative, hence why over $55 billion, possibly more, was lost to scams in 2022. From phishing emails to fake investment schemes, scammers are constantly devising new ways to trick unsuspecting individuals. To protect yourself and your hard-earned money, it's essential to be aware of potential scams and adopt preventive measures. This article will guide you through simple and effective steps to scam-proof your life.

Understanding Common Scams

Before diving into preventive measures, it's crucial to familiarize yourself with some common scams:

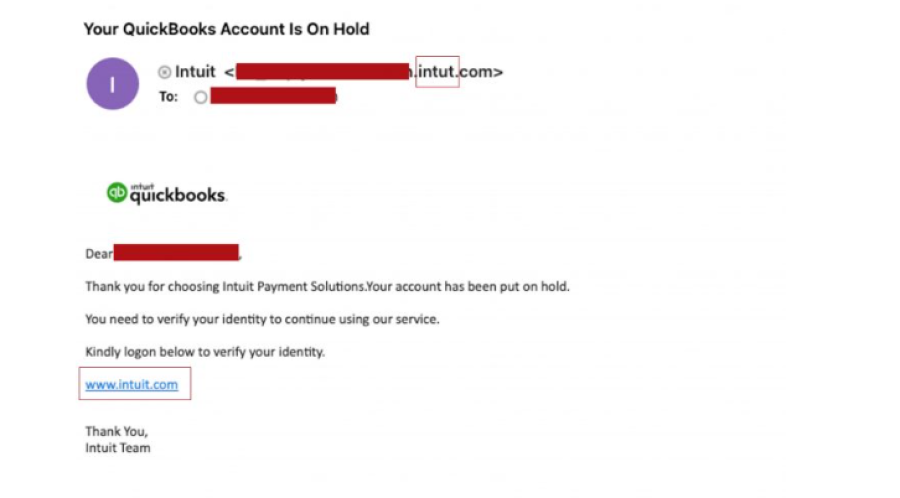

Phishing Scams

These scams involve fraudulent emails or messages that appear to be from reputable sources, asking for sensitive information such as passwords or credit card details. Usually, they impersonate popular brands and will usually claim there is something wrong with your account and you need to click on a link below. Woe unto you if you dare click on the said link.

Source: Trend Micro

Investment Frauds

With tough economic times, many people are looking for ways to make extra income, and this is where scammers are taking advantage. These fraudsters may promise quick and high returns on investments, enticing individuals to part with their money in fake schemes. Generally, most fraudulent investment scam sites will use language such as "risk-free prosperity", "financial freedom," and "secure profit."

Online Shopping Scams

Fake online stores or sellers may offer enticing deals on products but fail to deliver once they've received payment. Some of the other telltale signs include high-pressure sales tactics, copied content, unclear location and contact information, dummy social media handles, and much more. Read more in our article on how to recognize a scam website.

Lottery or Prize Scams

Source: unsplash.com

Scammers may contact you, claiming that you've won a prize or lottery, but they'll ask for upfront fees or personal information to claim the reward. If you agree to this, you will likely fall prey to money mule scams, and your details may be used in money laundering schemes.

Romance Scams

Romance scams have become increasingly prevalent on online dating platforms, preying on individuals seeking genuine connections. Scammers create fake profiles and build emotional relationships with their targets, only to exploit them for financial gain.

One infamous example of romance scams involved the case of the "Tinder Swindler." In this well-publicized incident, a charming con artist exploited the trust of unsuspecting individuals on the popular dating app, Tinder. The swindler used fake profiles to connect with victims, establishing an emotional connection before asking for money under various pretenses, such as emergency medical expenses or travel costs.

Tech Support Scams

Source: pexels.com

Fraudsters may pose as tech support agents, convincing you that your computer has a problem and offering to fix it for a fee. As simple as this sounds, people still lose money to these phony schemes.

Other notable mentions;

- Text scams

- Facebook marketplace scams

- Crypto scams

- Malware scams

- Advance fee scams

- Bait and switch scams

So, how do you scam-proof your life? Well, there isn’t a way that fits all approaches, but rather a combination of tricks that can help you create a cheat sheet. Here are some of them;

Strengthening Password Security

One of the easiest ways scammers can gain access to sensitive information is through weak passwords. Follow these tips to strengthen your password security:

a. Use Unique Passwords: Avoid using the same password for multiple accounts. Create unique passwords for each account to prevent a domino effect in case one gets compromised.

b. Mix It Up: A strong password should include a mix of uppercase and lowercase letters, numbers, and special characters.

c. Long and Complex: Aim for passwords that are at least 12 characters long, making them more difficult to crack.

d. Password Manager: Consider using a reputable password manager to securely store and generate complex passwords for all your accounts.

Spotting Phishing Attempts

Phishing attempts can be highly convincing, but with a discerning eye, you can identify them and avoid falling for them:

a. Check the Sender: Double-check the email address of the sender to ensure it matches the official contact information of the organization they claim to represent.

b. Hover over Links: Before clicking on any links in an email, hover your mouse pointer over the link to see the actual URL. If it looks suspicious, don't click on it.

c. Beware of Urgency: Scammers often create a sense of urgency to prompt immediate action. Take a step back and verify the legitimacy of the request before acting.

d. Look for Typos and Poor Grammar: Many phishing emails contain spelling mistakes and grammatical errors. Legitimate companies usually send out well-written communications.

Never click on anything you are not sure about. In the war against scammers, it is better to be safe than sorry!

Being Cautious with Investments

Investment scams can lead to significant financial losses. Stay vigilant with these investment tips:

a. Research Thoroughly: Investigate any investment opportunity thoroughly before committing funds. Check for reviews, consult with experts, and verify the legitimacy of the investment firm.

b. Avoid High-Pressure Sales Tactics: Be cautious of investment opportunities that pressure you to decide quickly, as legitimate investments are rarely time-sensitive.

c. Diversify Investments: Diversifying your investments across various assets can reduce the risk of losing all your money in a single fraudulent scheme.

d. Don’t Believe Guaranteed Returns: There is no such thing as guaranteed returns. No matter how enticing it is, investments are not guaranteed, even if they claim they are using the latest technology.

Remember, if it's too good to be true, it probably is, so avoid high returns investments, they will make you poor in the process.

Securing Your Online Transactions

Source: unsplash.com

Protecting your financial information during online transactions is vital to preventing fraud:

a. HTTPS: Ensure that websites, where you enter sensitive information, have "https://" at the beginning of the URL, indicating a secure connection.

b. Verified Payment Methods: When making online purchases, use trusted and verified payment methods such as PayPal or secure credit cards.

c. Avoid Public Wi-Fi: Refrain from entering sensitive information when connected to public Wi-Fi networks, as they are more susceptible to hackers.

d. Avoid Non-Traceable Payment Methods: If a store insists on payment methods that cannot be traced, like gift cards or crypto, avoid them.

Authenticate Websites and Sellers

When shopping online, it's essential to ensure that you're dealing with legitimate websites and trustworthy sellers. Follow these steps to authenticate the authenticity of the online store and the seller:

a. Check Website URLs: Before making any purchase, carefully examine the website's URL. Legitimate websites usually have "https://" at the beginning, indicating a secure connection. Avoid websites with misspelled URLs or unusual domain names.

b. Read Customer Reviews: Look for customer reviews and ratings of the online store or seller. Reviews can provide valuable insights into the quality of products and the seller's reliability.

c. Verify Contact Information: Legitimate sellers provide clear and accessible contact information, including a physical address and customer support details. Ensure the information provided is valid and matches the seller's claims.

Avoid shops that rush you into confirming a purchase; double-check the payment methods, and be wary of huge discounts and cheap prices.

Secure your Heart and your Finances

Here's how you can protect yourself from romance scams:

a. Slow Down and Be Cautious: If someone you meet online quickly professes their love and starts asking for money or financial assistance, be wary. Take your time to get to know the person, and never rush into sending money or personal information.

b. Avoid Sharing Sensitive Information: Refrain from sharing sensitive details like your home address, social security number, or financial information with someone you've just met online.

c. Verify Their Identity: Use reverse image search tools to ensure the profile pictures of the person you're chatting with aren't stolen from other sources.

d. Trust Your Instincts: If something feels off or too good to be true, it probably is. Trust your instincts, and don't ignore any red flags.

Romance scammers will always come with the most sentimental stories there are; keep your wits about you and don't fall for them. Remember, when your heart and mind are torn, trust your mind.

Image source: twitter.com

Report a Scam!

Have you fallen for a hoax, bought a fake product? Report the site and warn others!

Scam Categories

Help & Info

Popular Stories

As the influence of the internet rises, so does the prevalence of online scams. There are fraudsters making all kinds of claims to trap victims online - from fake investment opportunities to online stores - and the internet allows them to operate from any part of the world with anonymity. The ability to spot online scams is an important skill to have as the virtual world is increasingly becoming a part of every facet of our lives. The below tips will help you identify the signs which can indicate that a website could be a scam. Common Sense: Too Good To Be True When looking for goods online, a great deal can be very enticing. A Gucci bag or a new iPhone for half the price? Who wouldn’t want to grab such a deal? Scammers know this too and try to take advantage of the fact. If an online deal looks too good to be true, think twice and double-check things. The easiest way to do this is to simply check out the same product at competing websites (that you trust). If the difference in prices is huge, it might be better to double-check the rest of the website. Check Out the Social Media Links Social media is a core part of ecommerce businesses these days and consumers often expect online shops to have a social media presence. Scammers know this and often insert logos of social media sites on their websites. Scratching beneath the surface often reveals this fu

So the worst has come to pass - you realise you parted with your money too fast, and the site you used was a scam - what now? Well first of all, don’t despair!! If you think you have been scammed, the first port of call when having an issue is to simply ask for a refund. This is the first and easiest step to determine whether you are dealing with a genuine company or scammers. Sadly, getting your money back from a scammer is not as simple as just asking. If you are indeed dealing with scammers, the procedure (and chance) of getting your money back varies depending on the payment method you used. PayPal Debit card/Credit card Bank transfer Wire transfer Google Pay Bitcoin PayPal If you used PayPal, you have a strong chance of getting your money back if you were scammed. On their website, you can file a dispute within 180 calendar days of your purchase. Conditions to file a dispute: The simplest situation is that you ordered from an online store and it has not arrived. In this case this is what PayPal states: "If your order never shows up and the seller can't provide proof of shipment or delivery, you'll get a full refund. It's that simple." The scammer has sent you a completely different item. For example, you ordered a PlayStation 4, but instead received only a Playstation controller. The condition of the item was misrepresented on the product page. This could be the